Activity 1.2 | Managing and Leading in the ECE sector

Financial Management

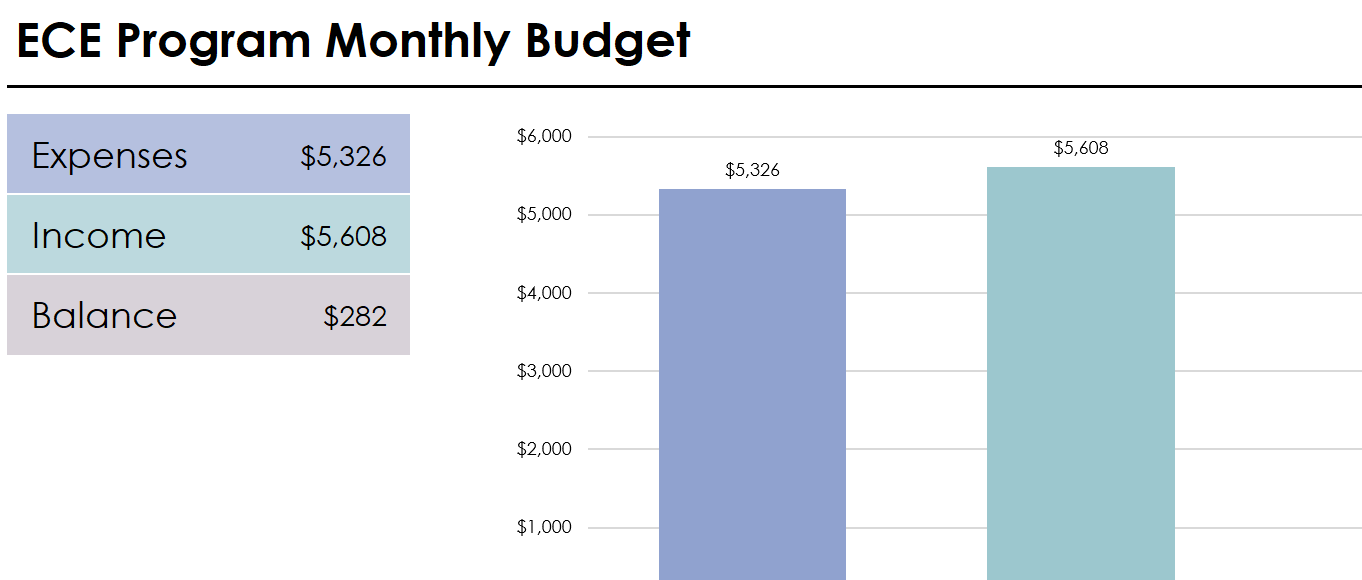

Budget

Some common expenses an ECE manager may have are:

- Rent

- Salaries

- Business Insurance

- Utilities

- Cleaning fees

- Professional development

- Meals and snacks

- Professional fees

- Marketing

To offset these costs, you need to have a viable program with regular fees and other resources coming in to balance the budget.

To help you plan your ECE programming budget, you can access and download a copy of this Microsoft Excel sheet and change the items to match your needs. Microsoft has many free business budget templates if you prefer a different layout.

The Financial Consumer Agency of Canada (2024) also provides resources, including budgeting tips and a financial calculator to help small business owners organize their budgets. Additionally, an excellent resource on financial literacy is available on the National Financial Strategy website, where the agency encourages saving three to six months of income for emergencies:

Regardless of the budgeting method you choose, an ECE manager must have an organized budget that includes clear categories for income and expenses, tracks your regular program spending, sets realistic financial goals, prioritizes savings, and allows for adjustments as needed.

Spend some time reviewing your current budget and assessing the efficacy of your current system.

Consider:

- Are your spending categories aligned with your financial goals? Or do you need to make adjustments to prioritize your objectives better?

- How consistently are you reviewing and tracking your expenses? What improvements can you make to ensure more proactive financial management?

- In what ways does your current method of budgeting support or hinder your ability to save for future emergencies?